Investment Analysis

-

Compare gross margin consistency across industry peers07/13/2025

Compare gross margin consistency across industry peers07/13/2025 -

How to Get Free Clothes from Shein: Everything You Need to Know07/11/2025

How to Get Free Clothes from Shein: Everything You Need to Know07/11/2025 -

Evaluate the shape of yield curves for interest rate exposure07/08/2025

Evaluate the shape of yield curves for interest rate exposure07/08/2025 -

Track volatility-adjusted returns across timeframes07/03/2025

Track volatility-adjusted returns across timeframes07/03/2025 -

Backtest factor exposures to validate alpha generation06/25/2025

Backtest factor exposures to validate alpha generation06/25/2025 -

Use correlation metrics to understand portfolio overlaps06/22/2025

Use correlation metrics to understand portfolio overlaps06/22/2025 -

Review changes in working capital to spot operational shifts06/18/2025

Review changes in working capital to spot operational shifts06/18/2025 -

Check debt-to-equity trends during expansion phases06/16/2025

Check debt-to-equity trends during expansion phases06/16/2025 -

Assess ROIC to determine capital efficiency06/13/2025

Assess ROIC to determine capital efficiency06/13/2025 -

Look at PEG ratio for growth-adjusted valuation06/09/2025

Look at PEG ratio for growth-adjusted valuation06/09/2025 -

Use relative strength index to track technical momentum06/06/2025

Use relative strength index to track technical momentum06/06/2025 -

Assess goodwill and intangible build-up on the balance sheet06/01/2025

Assess goodwill and intangible build-up on the balance sheet06/01/2025 -

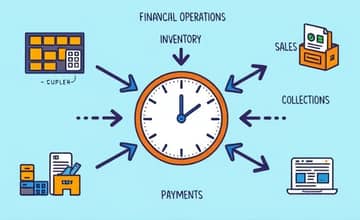

Review cash conversion cycle for liquidity insights05/31/2025

Review cash conversion cycle for liquidity insights05/31/2025 -

Check customer acquisition cost trends in high-growth firms05/27/2025

Check customer acquisition cost trends in high-growth firms05/27/2025 -

Analyze competitor positioning within market share dynamics05/25/2025

Analyze competitor positioning within market share dynamics05/25/2025 -

Use discounted cash flow models with scenario sensitivity05/21/2025

Use discounted cash flow models with scenario sensitivity05/21/2025 -

Compare dividend payout ratio with long-term earnings history05/16/2025

Compare dividend payout ratio with long-term earnings history05/16/2025 -

Assess sector rotation as part of cyclical positioning05/14/2025

Assess sector rotation as part of cyclical positioning05/14/2025 -

Monitor insider trading as a confidence indicator05/12/2025

Monitor insider trading as a confidence indicator05/12/2025 -

Evaluate revenue concentration risk in business models05/11/2025

Evaluate revenue concentration risk in business models05/11/2025 -

Use free cash flow yield to assess capital flexibility05/05/2025

Use free cash flow yield to assess capital flexibility05/05/2025

Latest Articles

-

10/29/2025Global commodity supercycles influence monetary regimes

10/29/2025Global commodity supercycles influence monetary regimes -

10/25/2025Use dynamic asset allocation funds for built-in risk control

10/25/2025Use dynamic asset allocation funds for built-in risk control -

10/24/2025Foreign aid priorities shift with donor country elections

10/24/2025Foreign aid priorities shift with donor country elections -

10/20/2025Agricultural innovation becomes a strategic economic lever

10/20/2025Agricultural innovation becomes a strategic economic lever -

10/20/2025Dual-tranche instruments allow diversification within one security

10/20/2025Dual-tranche instruments allow diversification within one security -

10/19/2025Analyze unit investment trusts for fixed-term exposure

10/19/2025Analyze unit investment trusts for fixed-term exposure