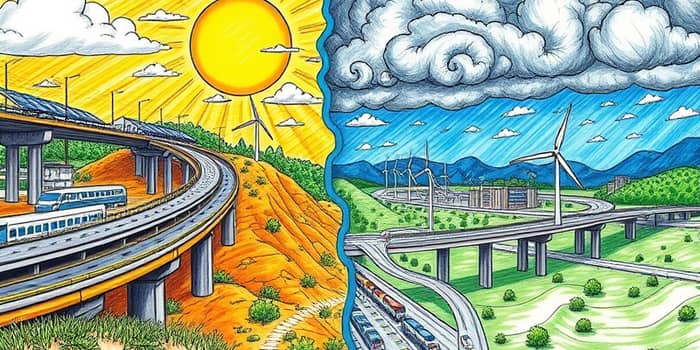

Infrastructure investors today face an unprecedented challenge: adapting to a changing climate while safeguarding returns. With rising temperatures, more frequent storms, and shifting regulatory landscapes, incorporating climate risk into investment models has become a financial imperative for every investor. This article outlines the urgency, identifies key risk types, surveys cutting-edge methodologies, and offers practical strategies to ensure that capital flows into resilient, sustainable assets. By embracing a holistic, systems-based approach, decision-makers can protect portfolios, communities, and the planet for generations to come.

Recent studies warn that without sufficient adaptation measures, investors could be losing up to half of their portfolios by mid-century due to damage from extreme weather and sea-level rise. Developing economies, where basic roads, power plants, and bridges underpin growth, are often the most vulnerable. Between 1997 and 2017, the number of global climate change laws surged twentyfold, amplifying transition risk through sudden regulatory changes. As governments race to meet net-zero targets, lagging behind on risk integration will mean higher costs, stranded assets, and potentially catastrophic portfolio losses.

For investors committed to long-term value creation, factoring climate risk is no longer optional. It is a cornerstone of prudent decision-making and system-level climate resilience thinking that extends beyond single-asset analysis to interconnected networks.

Understanding climate risk requires distinguishing between two broad categories:

Successful investment models must integrate both dimensions. Ignoring physical threats can lead to abrupt losses, while underestimating transition challenges risks regulatory fines, technology obsolescence, and reputational harm.

Traditional assessments often treat infrastructure assets in isolation, evaluating each bridge, road, or power plant on its own merits. This siloed approach misses critical interdependencies—if a flood damages an access road, nearby schools or hospitals become unreachable, regardless of their individual robustness.

The emerging focus on integrated scenario-based planning and analysis calls for viewing infrastructure as an interconnected ecosystem. By assessing how elements interact under various climate scenarios, investors and planners can design networks that adapt, reroute, or absorb shocks, minimizing cascading failures and maximizing reliability.

Advanced frameworks are now available to translate climate data into actionable investment insights. These tools provide standardized approaches and common languages for asset managers, engineers, and financial institutions.

Leveraging these methodologies equips investors to evaluate risk consistently, compare assets, and integrate findings into due diligence, credit assessments, and board-level reporting.

Moving beyond asset-level resilience, investors should adopt forward-looking evaluation metrics and incentives that capture system-wide strengths and vulnerabilities. Forward-looking credit ratings and regulatory stress tests increasingly hinge on these indicators, rewarding investments that prioritize adaptation and penalizing those that do not.

By embedding climate risk metrics into capital allocation decisions, financial institutions can redirect funding toward projects that bolster community resilience, attract lower-cost financing, and align with evolving regulatory requirements.

Investing in climate-resilient infrastructure extends benefits far beyond asset performance. Resilience measures safeguard communities, protect vulnerable populations, and reduce macroeconomic exposure to climate shocks. Conversely, neglecting climate risk can trigger systemic failures—disrupted supply chains, power outages, and transportation breakdowns—that carry profound social and economic costs.

By prioritizing adaptation, investors help catalyze sustainable development, foster job creation in green sectors, and ensure that essential services remain functional under stress.

In today’s climate-constrained world, factoring risk into infrastructure investment models is a vital component of responsible finance. Success hinges on embracing systems resilience, leveraging standardized tools like PCRAM and CliFin, and embedding climate considerations across project lifecycles. Through dynamic scenario planning, data-driven design, and cross-sector collaboration, investors can unlock sustainable opportunities, protect communities, and generate resilient returns. The era of reactive investment is fading—climate-smart strategies now define the path to lasting value and a safer, more sustainable future.

References