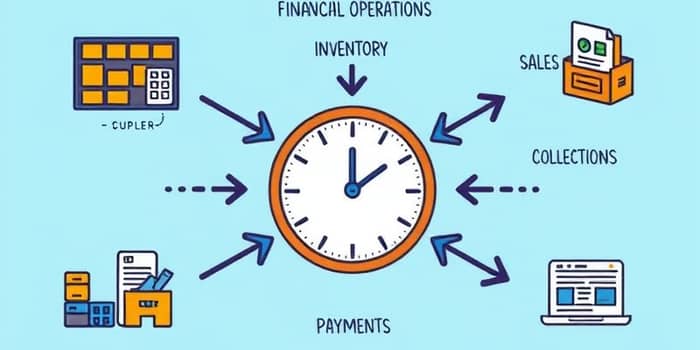

In today’s fast-paced business environment, understanding how quickly cash moves through operations is essential for maintaining robust financial health. The Cash Conversion Cycle (CCC) is a powerful metric that reveals how long funds remain tied up in various stages of production and sales before returning as cash.

The Cash Conversion Cycle expresses the average number of days it takes for a company to convert investments in inventory and resources back into cash through sales. It tracks the period from purchasing raw materials through selling finished goods and collecting receivables, offset by the time taken to pay suppliers.

Often called the net operating cycle focused on procurement to cash, the CCC highlights potential liquidity bottlenecks and efficiency gaps. A thorough grasp of this cycle equips finance leaders with insights to optimize working capital and support strategic growth.

The CCC comprises three primary elements. Each component measures a critical phase of operational cash flow:

The core formula reads:

CCC = (DIO + DSO) – DPO

Accurate calculation of the CCC requires financial data from the balance sheet and income statement for a chosen period. Follow these steps:

For example, a retail business might have:

Inventory of $2,000,000 with COGS of $15,000,000 yields DIO of about 48.6 days. Accounts receivable of $500,000 against $10,000,000 revenue gives DSO of 18.25 days. Payables of $1,000,000 and COGS of $15,000,000 produce a DPO of 24.3 days. Therefore, CCC = (48.6 + 18.25) – 24.3 = 42.55 days.

Whether a CCC value is “good” depends heavily on industry practices and business models. In general:

A lower or negative CCC suggests that cash is recouped quickly, boosting operational flexibility during market fluctuations. By contrast, a prolonged CCC may strain liquidity, requiring external financing or delaying strategic investments.

Below are average CCC figures across major U.S. sectors:

For instance, a negative CCC in the industrials sector indicates suppliers effectively fund working capital, enabling companies to collect cash before paying for inventory.

Improving the cash conversion cycle can unlock significant working capital, enabling reinvestment in growth initiatives or debt reduction. Key strategies include:

These tactics empower finance and operations teams to work in tandem, aligning procurement, sales, and finance objectives to achieve efficient cash flow realization.

While CCC is a powerful indicator of liquidity, it does not capture every cash movement. Capital expenditures, tax payments, interest, and non-operating cash flows lie outside its scope. Companies with pronounced seasonal cycles or irregular sales patterns may need to adjust calculations for meaningful comparisons.

Furthermore, a negative CCC can be misleading in certain contexts. High-volume, low-margin businesses, particularly in e-commerce, may exhibit negative cycles due to customer prepayments and drop-shipping models. Always compare CCC metrics with peer benchmarks within the same industry to draw actionable insights.

Regular assessment of the cash conversion cycle serves as an early warning system. A sudden elongation of the CCC can signal inventory build-up, tightening credit terms, or operational inefficiencies. Conversely, improvements in the cycle can highlight successful process enhancements and stronger negotiating positions with suppliers or customers.

Finance leaders should integrate CCC tracking into monthly or quarterly reporting dashboards, ensuring visibility among stakeholders. By aligning key performance indicators with liquidity objectives, organizations can maintain agility and resilience in the face of evolving market dynamics.

Understanding and managing the Cash Conversion Cycle is critical for maintaining strong liquidity and operational efficiency. By accurately calculating DIO, DSO, and DPO, comparing benchmarks across peers, and implementing targeted strategies, businesses can release trapped capital and support sustainable growth.

Ultimately, a well-optimized CCC reflects a healthy balance between inventory management, sales effectiveness, and supplier relationships. Embracing this metric as part of a broader working capital framework empowers decision-makers to drive performance and safeguard financial stability.

References